Financing zero: The road to emission-free fleets

Tali Zuckerman

Wed, 11/04/2020 – 02:00

In recent years, electric vehicle (EV) adoption has accelerated in the world of personal cars. Now, as ambitious climate goals gain momentum and renewable energy prices drop, attention is turning towards scaling such systems for commercial transport.

But before zero-emission vehicle (ZEV) fleets can hit the road, stakeholders must find innovative ways to finance them in a way that is accessible, affordable and attractive to corporate buyers.

At the VERGE 20 conference last week, industry experts working on this very question joined moderator Niki Okuk, alternative fuels program manager at CALSTART, to discuss the biggest financial barriers to making large-scale ZEV deployments a reality and the innovative financial tools being designed to address them.

Challenges on the road to commercial ZEVs

One key challenge addressed by the panelists is the volatility of renewable energy — both in price and physical availability.

Vic Shao, chief executive of charging infrastructure company Amply Power, highlighted that while fossil-fuel prices typically fluctuate about 25 percent per year, renewable energy prices can experience shocks of up to 400 percent in just one day. For large-scale fleet managers, this makes adopting ZEV solutions incredibly tricky.

“The CFOs of the organization can’t really understand the cost structure over weeks, months and years,” said Chelle Izzi, executive director of NextEra Energy Resources. “That makes it difficult for us to scale up.”

Prices also vary across countries and states, due to inconsistencies in taxes and policies.

Pooling a bunch of these different challenges under 1 contract would manage some of that new technology risk and those demand charge risks.

In terms of physical abundance of electricity, Izzi was quick to add: “I had a power outage this week — it’s not just theoretical.” She was referencing proactive power shutdowns in Northern California made in late October to prevent the spread of wildfires.

When looking to transition fleets to vehicles that use renewable energy, owners and managers must plan such instability into their operations from the start — a fact that makes financial forecasts and plans quite difficult, the panelists said.

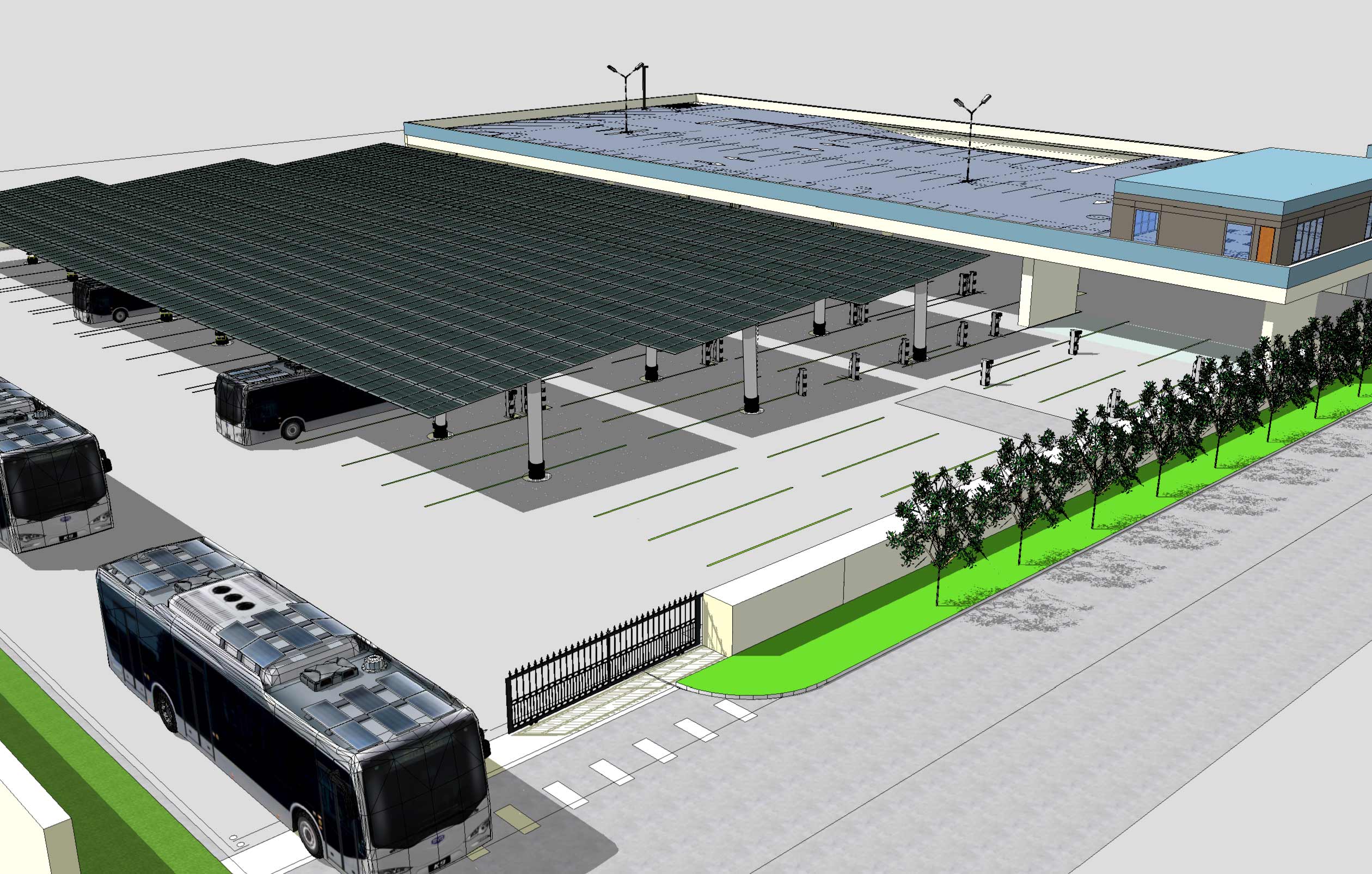

This reality is compounded by the lack of expansive infrastructure to support large-scale fleets. While EV charging stations have been popping up around the country, they are not enough to reliably power full commercial fleets, the panelists noted.

Developing an ZEV infrastructure requires an immense upfront investment and introduces operational risks related to the general uncertainty and immaturity of the market. Andrew Kessler, a managing director at the NY Green Bank who works on financing such projects, said this risk has translated to limited access to capital for small companies trying to scale innovative solutions.

Finance to the rescue

Despite these challenges, the panelists remained hopeful. Each has introduced innovative solutions that range from new financing models to investment in research for disruptive innovations and technologies.

Discussing ZEV fleets in New York state, Kessler said that his team hopes to push agencies to evaluate these investments using operational expense financing models rather than considering the cost solely from a capital expenditure perspective. Using an OpEx financing model could make fleet conversion more affordable by providing purchasers the opportunity to make smaller payments over time, he said.

Battery leasing is another model gaining traction, according to the panelists. Currently, batteries are the most expensive part of an electric vehicle; this model allows customers to purchase a vehicle upfront minus the battery, which is paid for in small increments comparable in cost to purchasing fuel for traditional trucks or buses.

Although battery-leasing programs are still mostly under development, Kessler pointed to one successful collaboration in the field by companies Proterra and Mitsui, currently leasing batteries for an all-electric bus fleet in Park City, Utah.

Leasing batteries also could become more affordable for fleets if stakeholders can determine that batteries have a higher residual value (such as for reuse or recycling). If lenders can be guaranteed some value at the end of a lease period, they can charge less for individual lease payments without losing out on profit, the panelists said.

Fleets of ZEVs also could become more attractive through innovative bundling of products and infrastructure services, which may help mitigate the current fluctuations in cost and supply of renewable energy.

“Pooling a bunch of these different challenges under one contract would manage some of that new technology risk and those demand charge risks,” explained Izzi.

We are comfortable with that risk, but how we work with the operators and the degradation as a result of how they actually use the vehicles is a different risk that we all have to figure out together.

Shao said Amply aspires to develop software to better understand, monitor and plan a fleet’s energy use, something which also could lower operational risks and make investments easier to justify.

Finally, each panelist stressed the importance of finding a way to properly distribute risk between operators, manufacturers and investors in order to unlock more stable financing mechanisms and returns in the future.

“We are very comfortable with storage as a technology, understanding degradation and the forward cost curves,” Izzi said. “We are comfortable with that risk, but how we work with the operators and the degradation as a result of how they actually use the vehicles is a different risk that we all have to figure out together.”

Key takeaways

Throughout the session, several themes reverberated between speakers.

First, each panelist stressed the need for public-private partnerships in the industry. While public subsidies have contributed to the preliminary infrastructure for fleet electrification, private investment is necessary to truly scale ZEV fleets.

Second, they discussed the ROI of electric fleets, each comparing the current state of the commercial ZEV market to that of solar power in the early days. Although investments now are full of risk, they also promise high rewards over time. Conversely, as ZEVs become commonplace, investment costs will plummet, but so will payoffs.

Third, each panelist mentioned the importance of market-based tools and tactics to prove returns, attract private capital and achieve the flexibility needed to support a growing market.

The tone of the panel was undeniably one of confidence in the promise of innovative financing to get ZEV’s to the finish line.

“The appetite for growth is there,” concluded Izzi. “We all believe that we can bring the scalability of what we have done in renewables to EV infrastructure … once the vehicles and pricing are there.”

VERGE 20

Electric Vehicles

Fleet